TerraUSD (UST) is rapidly becoming one of the most in demand stablecoins in the crypto industry with its market cap soaring to flip Binance USD.

Terra USD (UST), the Terra blockchain’s algorithmic stablecoin, has surpassed Binance USD (BUSD) to become the industry’s third-largest stablecoin, with a market cap of over $17 billion.

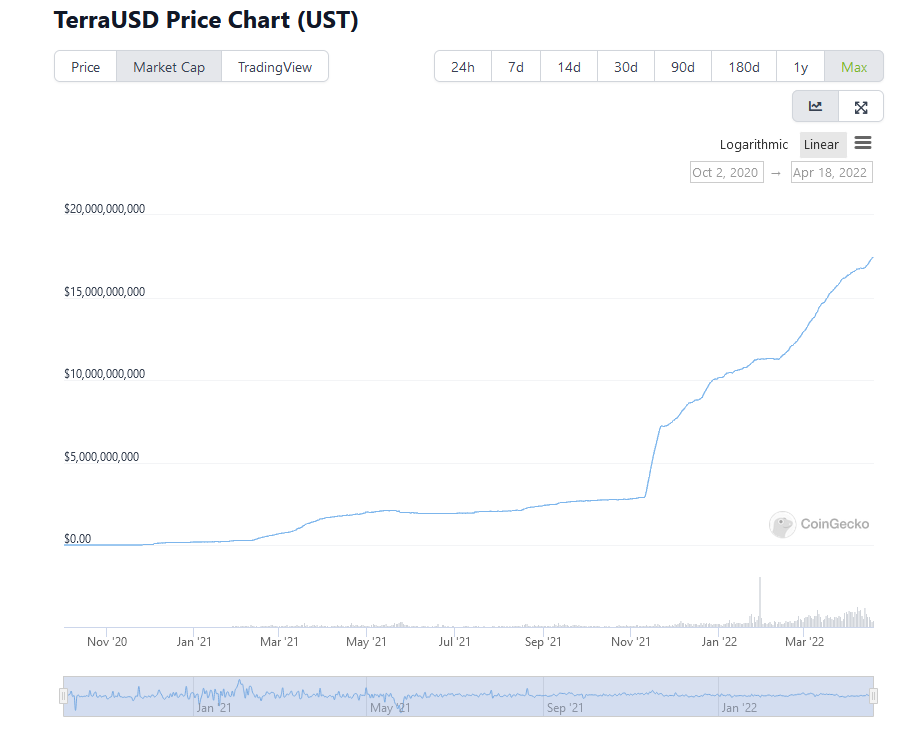

UST’s entire market capitalization has increased by 15% in the last 30 days, to $17.5 billion at the time of writing, according to CoinGecko. The figure now positions UST as the third-largest stablecoin after flipping BUSD with a slightly lower market cap of $17.46 billion.

The data also shows that UST has been on a parabolic rise since mid-November, with a 525 percent increase in market cap since then.

Stablecoins maintain the same value for cryptocurrency investors, traders, and exchanges by keeping the value pegged, providing a level of stability in a volatile market, and the market cap has risen to over $150 billion from $20 billion a year ago.

UST is a stablecoin tied to the US dollar that was released in September 2020. Its minting technique necessitates the burning of a reserve asset, such as Terra (LUNA), in order to mint an equivalent quantity of UST.

The asset is now only following industry titans Tether (USDT) at $82.8 billion and USD Coin (USDC) at $50 billion, despite the fact that the difference is fairly large at this point.

Terra has been making headlines recently as a result of LUNA Foundation Guard’s (LFG) plan to back the network’s stable coin reserves with a massive $10 billion in Bitcoin (BTC).

They’ve already started deploying their cash and have spent around $1.7 billion since beginning to buy in late January. Terra now owns 42,530 bitcoin, valued at $1.722 billion at the time of writing — only 700 tokens fewer than Tesla’s corporate treasury allocation.

So far, the purchases have been costly. Terra’s holdings have gone from about $200 million in profit to nearly $100 million in the red, due to the recent Bitcoin price drop. The bullish buy-ins, like the rest of the crypto market, aren’t doing much to push the price of LUNA up.