The cryptocurrency market appears to be reversing its gains since January as whales flock to sell their Bitcoin from cold wallets to centralized exchanges.

Bulls aren’t having it easy, as Bitcoin begins another week in the red after losing the previous six weeks, a scenario not seen in years.

The price of Bitcoin has dropped 6% in the last 24 hours to $32,050, according to TradingView, extending losses from the weekend after trading near $36,000 on Friday.

Ether, the second most valuable digital asset, is trading at a similar level as Bitcoin. Even worse, the majority of the crypto market is underperforming. AVAX, LUNA, DOT, ADA, SOL, and APE are all down 10%, 12%, 14%, 11%, 10%, and 14%, respectively.

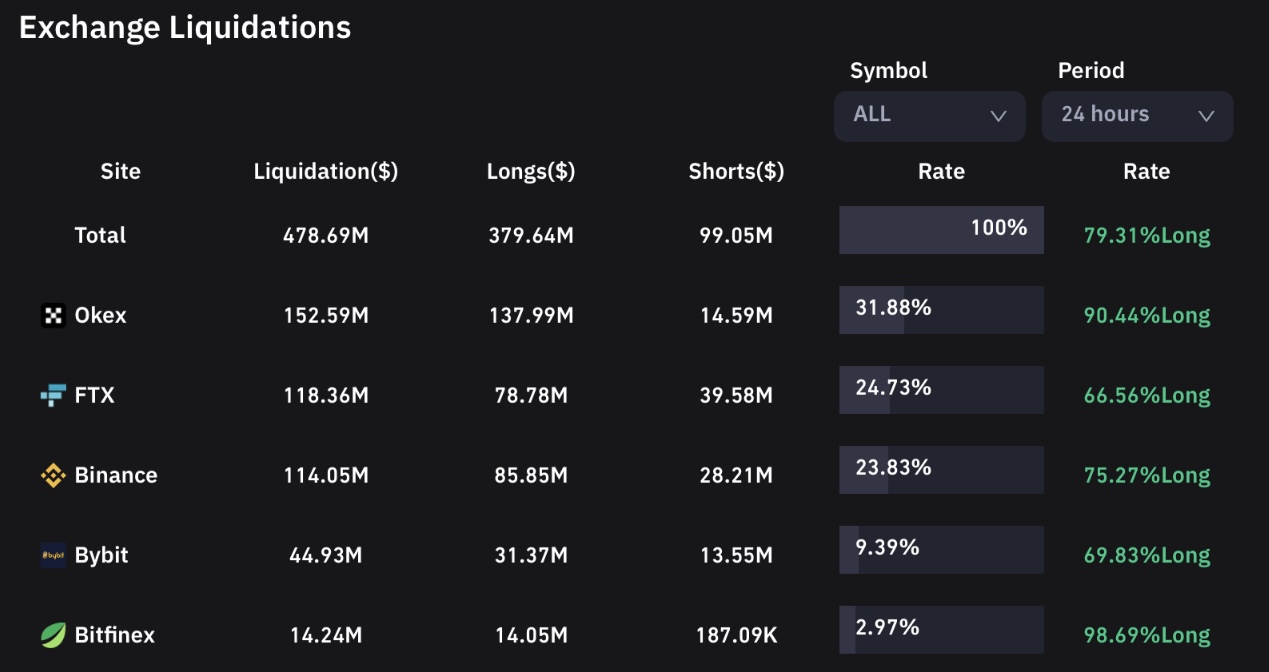

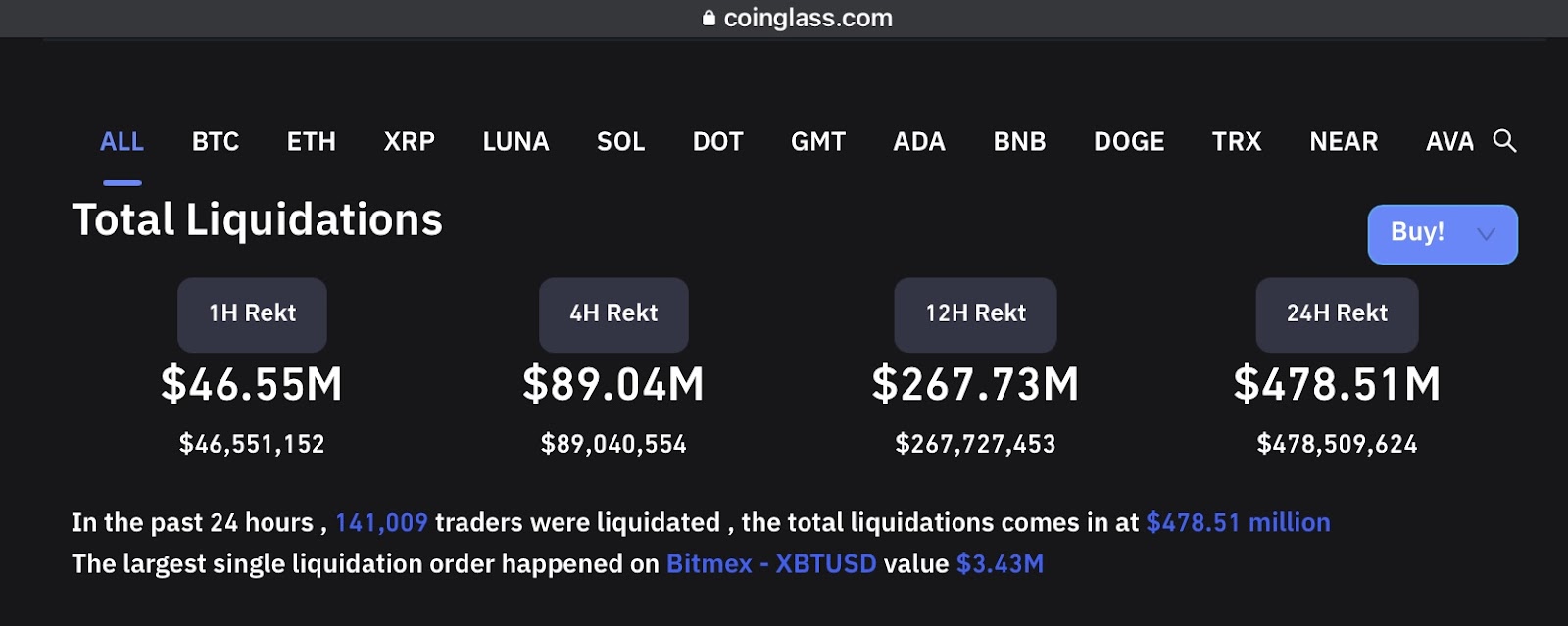

Traders betting on the price of Bitcoin and other cryptocurrencies falling in recent hours triggered a cascade of massive long order liquidations, accounting for 79.31 percent of total liquidations, according to coinglass figures.

141,009 traders around the cryptosphere liquidated their long orders in just 24 hours, bringing the total amount liquidated to $478 million, the highest so far this year.

The largest crypto has dropped to its lowest level since the beginning of the year, and the dip to just around $32k means it has dropped to its lowest level since July 2021, as investors continue to flee risky assets amid a shaky stock market and a difficult macroeconomic environment.

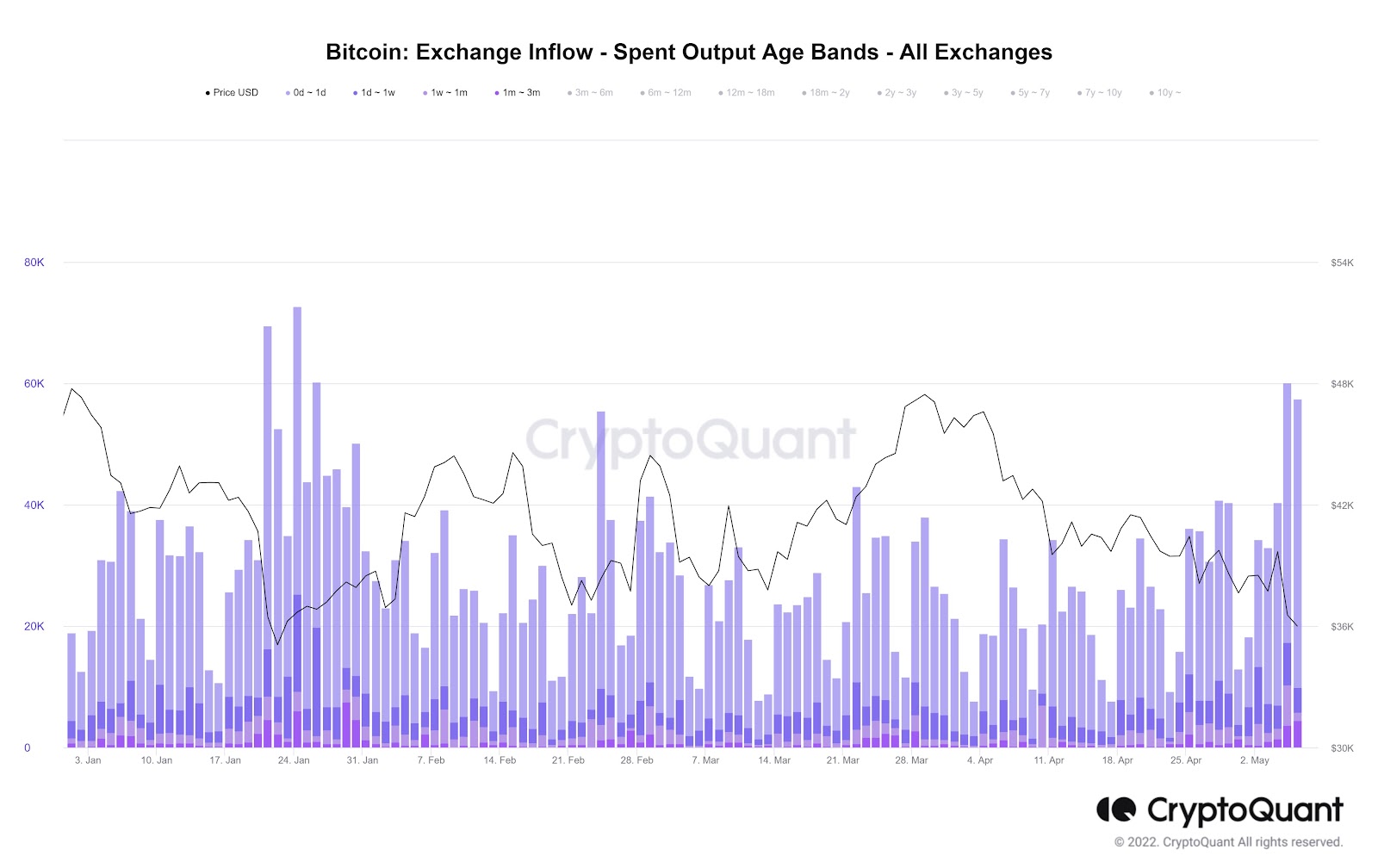

The strong sell-off can be ascribed to the number of Bitcoin whales rapidly declining to levels not seen since early this year, presumably as a result of the three-month high in bitcoin inflows to centralized exchanges.

Glassnode, a cryptocurrency market tracker, has released many gloomy signs for the largest cryptocurrency by market size, including data indicating a market exit for whales owning at least 1,000 coins and exchange inflows of more than 1.7 million coins, the highest since February.

High BTC inflows on CEX indicate that whales may be fleeing the market by selling coins, possibly in preparation for a prolonged market downtrend.

Short-term investors are most likely behind the inflows that have fuelled the drop in the last two days. Exchanges received a total of 11.76k BTC on the 5th and 6th, which had been held for less than 3 months.

Bitcoin’s price trajectory is unpredictable, and there are no clear signals as to what will happen in traditional markets, which are currently in a sea of red and will have a significant impact on Bitcoin’s path in the next months, so keep an eye on it and manage your portfolio carefully.