Following the lead of the US stock market, the crypto market dropped before recovering following the Fed’s latest interest rate hike.

On Wednesday, Bitcoin’s price was once again put to the test, falling below $20,000 per coin before rebounding to roughly $22,000 after the Federal Reserve declared it would keep raising interest rates.

The crypto market tanked this week after a major loan provider, Celsius, blocked withdrawals with real-world liquidity consequences, sparking fears of yet another example of fraud or Ponzi scheme implosion akin to the Terra debacle.

The global cryptocurrency market lost as much as $300 billion after Friday’s US CPI report as a result of the exacerbated macro-driven volatility that had been present since Friday’s US CPI release, and the carnage appeared to be far from over as fears grew over the Fed monetary policy statement released at 2:00pm ET on June 15th.

The Federal Reserve raised interest rates by 0.75 percent on Wednesday, the largest increase in 28 years. The central bank went on to say that it wouldn’t stop there, and that there will be more increases later this year.

Bitcoin, the most valuable cryptocurrency by market capitalization, fell to $20,392 on Wednesday afternoon Eastern Time as a result of this taking the rest of the crypto market down with it. It has now recovered, and it was trading at $22,316.66 on Bitstamp at the time of writing.

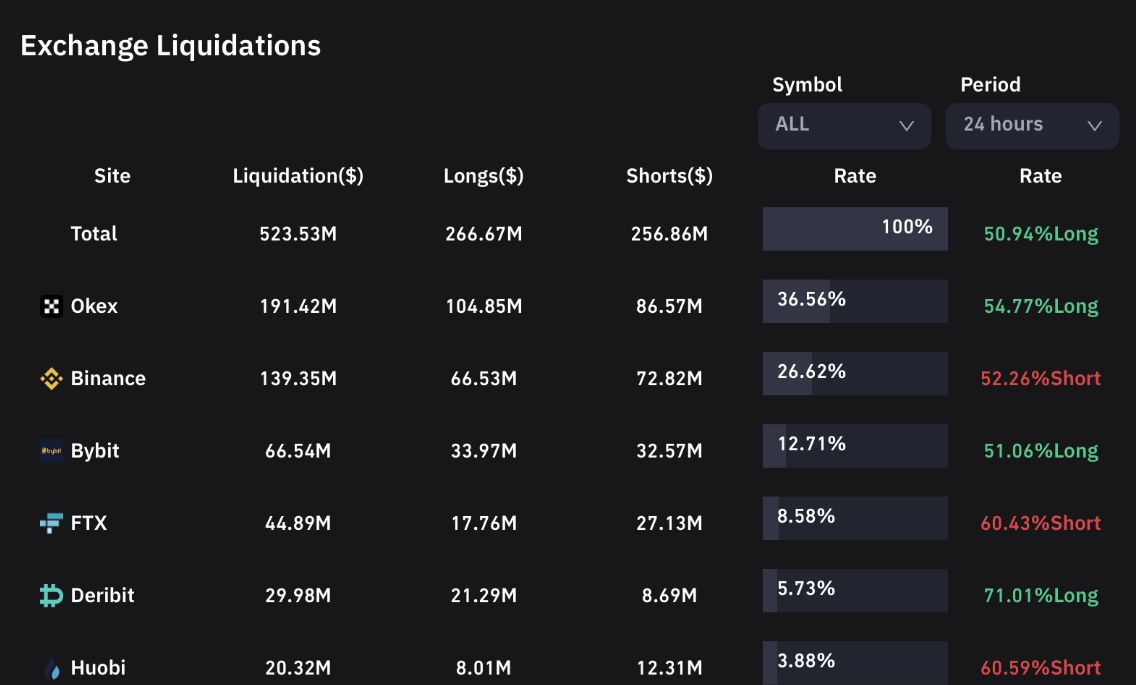

The indecisiveness in market price action has resulted in both long and short orders being liquidated in big numbers and in similar ratios. Longs account for 54.07 percent of total liquidations, according to coinglass data.

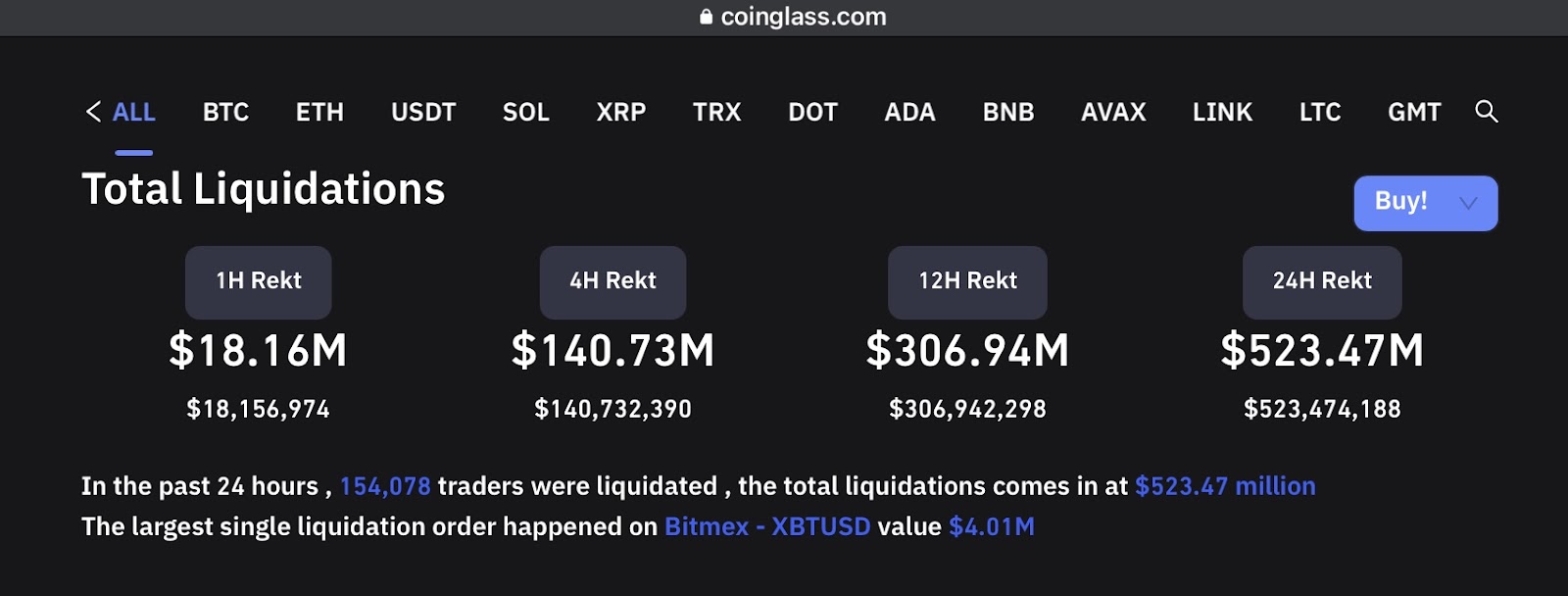

154,078 traders from throughout the cryptosphere liquidated their long orders in the last 24 hours, increasing the total amount liquidated to more than half a billion.

The constant downturn in Bitcoin’s price appears to have reached a bottom, but the price trajectory remains uncertain, and there are no clear clues as to what will happen in traditional markets, which will have a significant impact on Bitcoin’s direction, so keep an eye on it and manage your portfolio carefully.