Bitcoin staged a brief recovery rally, but the current market sell-off appears to be far from over, with Bitcoin falling below $40,000 once again.

Bitcoin (BTC) held on to further gains on April 14, rising to 41,563 after a rebound in line with the Wall Street open on April 13.

Following the U.S. Consumer Price Index (CPI) report for March, which showed an increase of 8.5 percent, the highest since 1981, the relief rally began on April 11. Meanwhile, the CPI in the United Kingdom increased to 7%, a 30-year high.

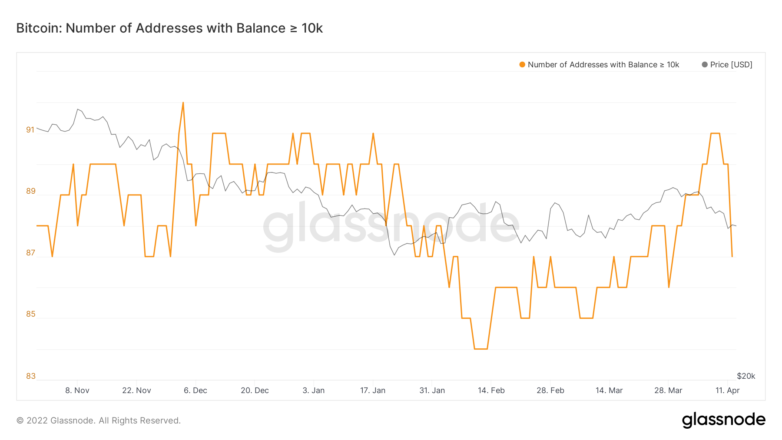

Despite the relief bounce, some Whales have been out in force during the last few days, selling or redistributing their token in what might be interpreted as an indication of prolonged market volatility.

The number of addresses on the network holding more than 10,000 BTC has decreased by more than 4.60 percent in the last four days, according to on-chain data. Within this brief time frame, at least four large whales have sold or reallocated their tokens.

Even though a recovery rally to nearly $42k appeared to be erasing the downward pressure, Bitcoin continued its downward trajectory. This is because these Whales addresses sold a lot of their coins, which cost leverage traders a lot of money because the total liquidations at derivatives exchanges reached $428 million.

Despite optimistic signals like fresh Terra buy-ins over the weekend, the data explains why Bitcoin has not been booming. The selling pressure caused by Whales dumping outnumbered Terra buy-ins throughout the weekend and during the depths.

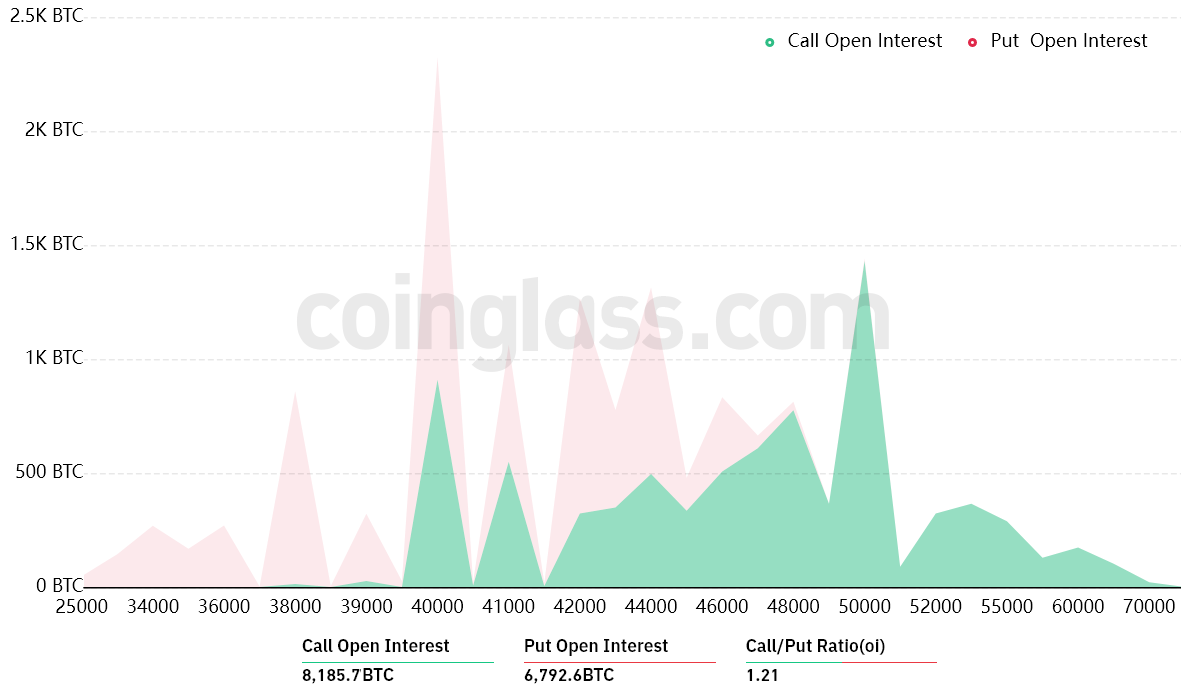

The open interest in Bitcoin options expiring on April 15 is $615 million, but the real figure will be significantly lower because bulls were overconfident after the rise to $48,000 late last month.

Bitcoin’s recent drop below $41,000 caught bulls off guard, with only 18% of call (buy) options for April 15 being placed below that price.

The $335 million call (buy) open interest dominates the $280 million put (sell) open interest, as seen by the 1.21 call-to-put ratio.

Only $62 million worth of call options will be available if Bitcoin’s price remains below $42,000 at 8:00 a.m. UTC on April 15. However, with Bitcoin hovering around $41,000, most bullish bets are likely to be useless.

Regardless of your stance, it’s important to remember that BTC’s price action in the future is dependent on its ability to hold above a critical psychological support level of $40,000.

The bulls and bears of Bitcoin are currently locked in a deadlock, with the cryptocurrency trading in a narrow range between $39,500 and $41,500. This choppy price action is likely to continue until BTC is able to decisively break above the $40,000 psychological level.