Jurrien Timmer, a macro strategist at financial giant Fidelity, says that Bitcoin (BTC) may have found a new level of support that’s 33% higher than previously believed.

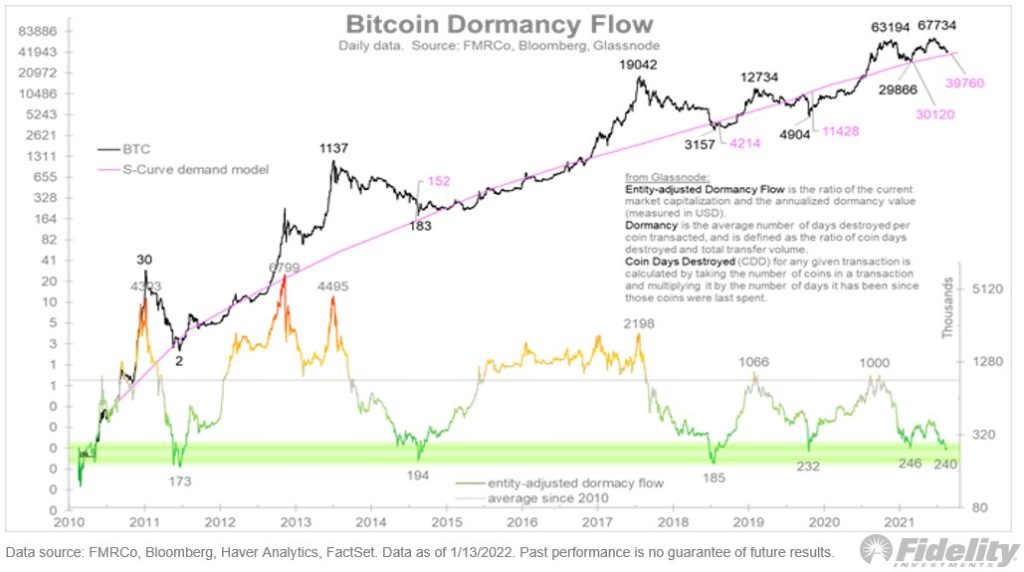

In a thread to his 80,000 Twitter followers, Timmer says that a little-known metric called “dormancy flow” might be the key to pegging Bitcoin’s bottom at $40,000.

“A few days ago I made the case that 40k could be the new 30k for Bitcoin, based on the rising intrinsic value from my S-curve model. I just came across an indicator that further suggests this: Dormancy flow. It has reached the kind of oversold levels seen at past bottoms.”

Timmer provides a chart that tracks data since Bitcoin’s 2011 inception in which the price of BTC ranges within the demand S-curve.

Concerning analytics firm Glassnode’s term “dormancy flow” and how it factors in time elapsed between coin transactions, Timmer says,

“To me, this is further evidence that 40k could be a major line in the sand, much like 30k was last year.”

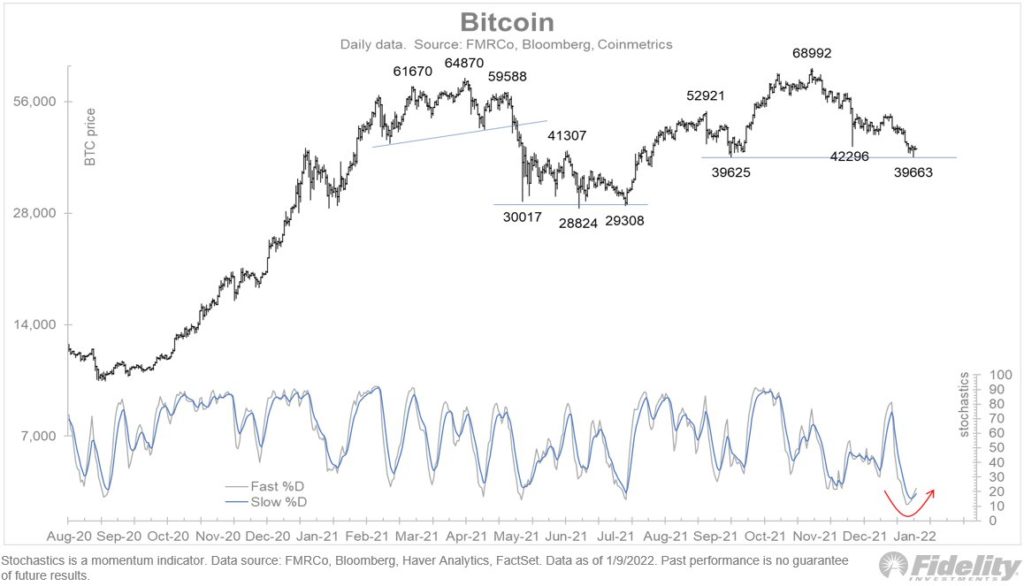

The tweet thread follows on the heels of a previous post where Timmer says in light of Federal Reserve policies and rising inflation, Bitcoin appears to be oversold at $40,000.

“Is $40k the new $30k? The Fed’s hawkish stance on inflation has had broad impact. With the liquidity-driven momentum plays under pressure, it’s not a total shock that crypto has corrected.”

The strategist concludes by saying that he believes Bitcoin remains a store-of-value asset just like gold.

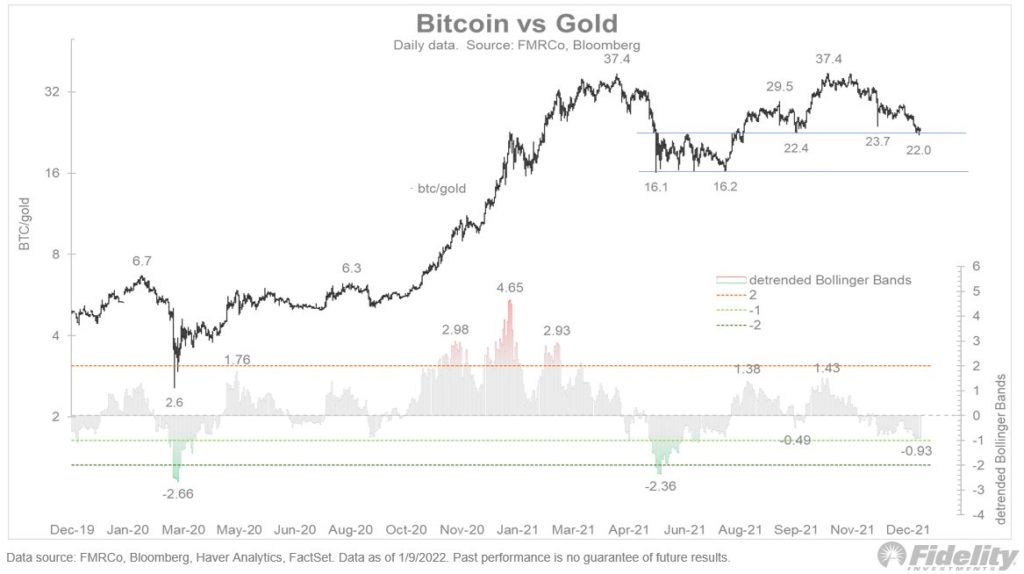

“I like to compare Bitcoin to that other more traditional store-of-value, gold.

Here we see that the BTC/gold ratio has fallen back to the breakout zone from last year.

Technically the ratio is moderately oversold.”