The Ethereum blockchain is struggling with scalability, which has made the network more expensive to use as more decentralized applications (dApps) are being developed on the platform.

The most widely used smart contract platform in the cryptocurrency world may be Ethereum, but its network is unquestionably congested and clogged, making gas costs for consumers intolerable.

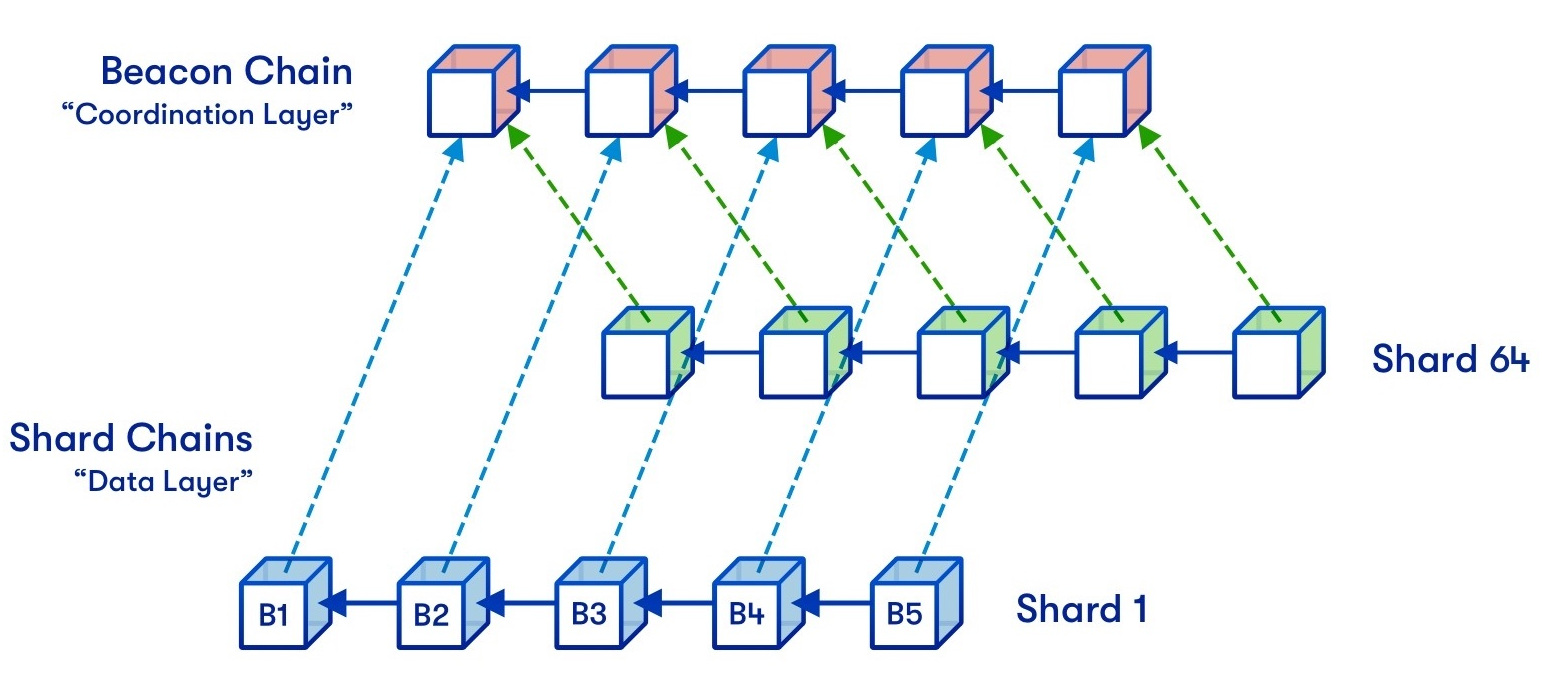

All eyes are on the next stage of the transition, which would provide important scalability solutions to the network, including sharding, following a successful Ethereum Merge. Sharding, according to market analysts, might transform the Ethereum network since it might be able to resolve the scalability woes.

Dr. Martin Hiesboeck, head of research at Uphold, discussed how sharding can enable Ethereum to become a genuinely global network in an exclusive interview with Cointelegraph.

According to Hiesboeck, blockchain networks’ long-standing scalability trilemma may one day be resolved via sharding. The scalability trilemma postulates that in order to scale, blockchains typically have to give up one of their three core principles: security, decentralization, or scalability itself. He clarified:

“Sharding is indeed one of the most effective and universal ways to solve the so-called ‘scalability trilemma.’ Not sure it’s sufficient to proclaim it the only true scalability solution, but sharding is definitely among the best ones we have at the moment.”

Using this approach, validators will publish signatures confirming their verification of specific blocks. Everyone else’s workload will be greatly reduced since they only need to verify 10,000 of these signatures as opposed to 100 entire blocks.

In addition to tripling Ethereum’s throughput, according to Hiesboeck, sharding would also reduce gas costs and improve the network’s energy efficiency. He explained that the energy saving and scalability both occur from “the smaller packets that have to be moved as sharding stores datasets in manageable blocks and allows additional requests to be executed at the same time.”

In the past, Ethereum developers planned to introduce 64 shards, each of which would require 8.4 million ETH to be staked in Eth2. The number of initial shards, however, may be larger than that given that there are currently around 13.8 million ETH staked.

Concerns over node concentration have also been brought up by the switch to PoS, particularly in light of the United States Securities and Exchange Commission’s (SEC) claims of jurisdiction over ETH and the fact that almost 43% of nodes are concentrated in the U.S. The claims made by the SEC regarding Ethereum, according to Hiesboeck, are incorrect. He described how the number of nodes could change suddenly and made the following claim:

“Ethereum nodes can pop up anywhere in the world, and while around nearly 43% of them are indeed centralized in the U.S. right now (the second-biggest country being Germany with 11.8%), this can change at a moment’s notice.”

Hiesboeck continued by adding that everything can be resolved given enough time because the Ethereum developer community has a track record and has already shown its resiliency.

Prior to “The Merge,” the Ethereum Foundation made it clear that, contrary to common assumption, the upgrade is not intended to lower gas fees but rather to reduce energy use by 99.9%.